The Facts About Stonewell Bookkeeping Uncovered

Stonewell Bookkeeping - An Overview

Table of ContentsSome Ideas on Stonewell Bookkeeping You Should KnowNot known Facts About Stonewell BookkeepingNot known Details About Stonewell Bookkeeping Getting The Stonewell Bookkeeping To WorkThe Ultimate Guide To Stonewell Bookkeeping

As opposed to going via a filing closet of various papers, billings, and receipts, you can provide detailed records to your accountant. Consequently, you and your accounting professional can conserve time. As an included reward, you might also be able to determine prospective tax obligation write-offs. After using your bookkeeping to submit your tax obligations, the IRS may select to do an audit.

That funding can be available in the type of proprietor's equity, gives, organization car loans, and capitalists. However, financiers require to have an excellent concept of your organization prior to spending. If you do not have audit records, financiers can not figure out the success or failure of your business. They need updated, precise info. And, that info needs to be easily available.

The 6-Second Trick For Stonewell Bookkeeping

This is not intended as lawful recommendations; to find out more, please click on this link..

We addressed, "well, in order to understand just how much you require to be paying, we need to know just how much you're making. What are your incomes like? What is your web income? Are you in any kind of financial obligation?" There was a long time out. "Well, I have $179,000 in my account, so I think my earnings (revenues much less expenses) is $18K".

Some Of Stonewell Bookkeeping

While it can be that they have $18K in the account (and even that may not be real), your equilibrium in the financial institution does not necessarily determine your revenue. If a person received a grant or a financing, those funds are not considered income. And they would certainly not function right into your revenue declaration in establishing your profits.

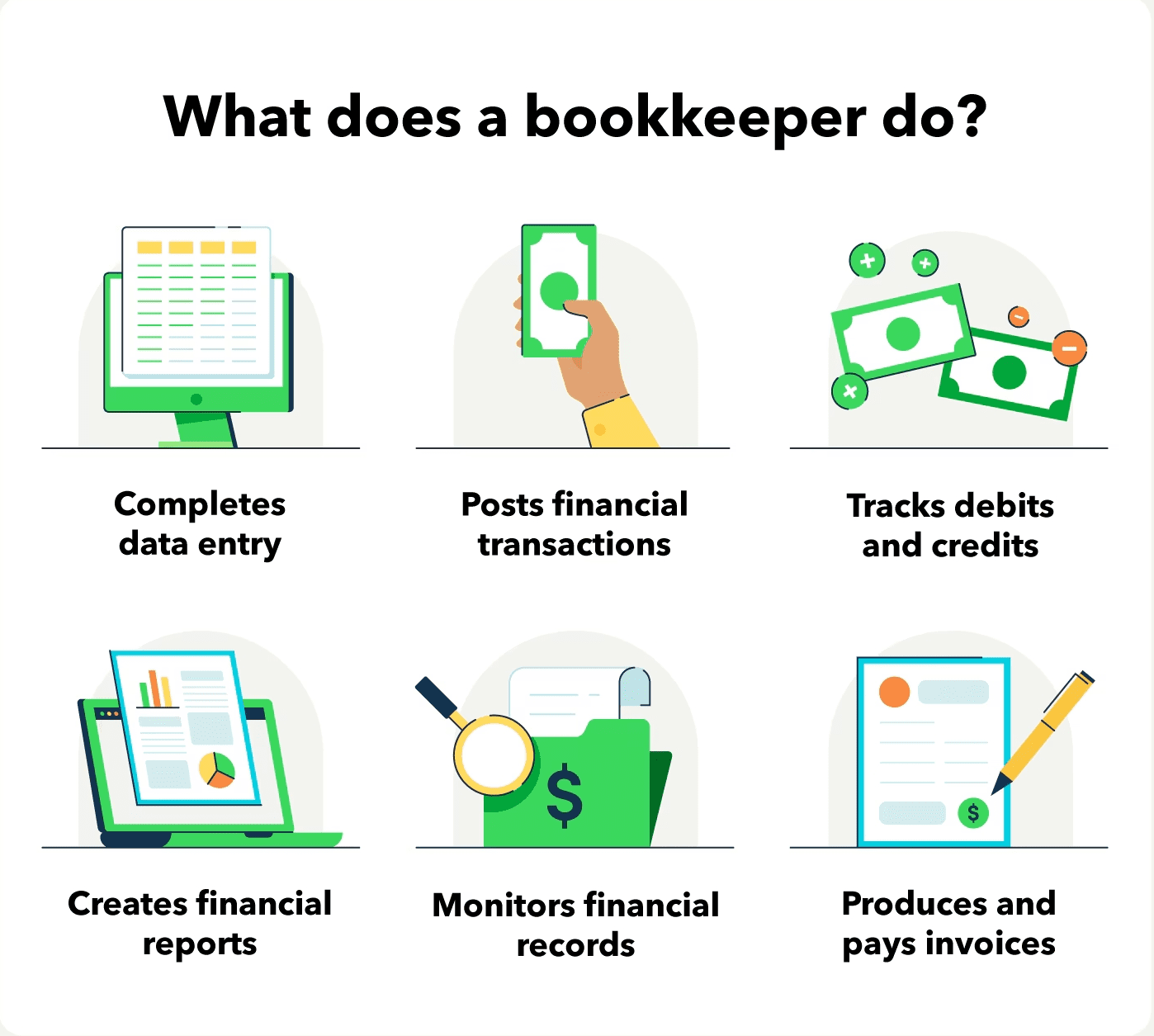

Many things that you believe are expenditures and deductions are in truth neither. A correct collection of books, and an outsourced bookkeeper that can appropriately identify those transactions, will help you determine what your service is actually making. Accounting is the process of recording, classifying, and organizing a company's monetary deals and tax obligation filings.

An effective organization requires assistance from professionals. With practical objectives and a proficient accountant, you can conveniently address challenges and keep those concerns at bay. We dedicate our power to guaranteeing you have a strong economic structure for development.

Rumored Buzz on Stonewell Bookkeeping

Accurate accounting is the backbone of good monetary management in any kind of company. With good accounting, companies can make far better choices because clear monetary records supply important information that can direct strategy and improve profits.

Exact financial statements develop trust fund with Discover More lenders and investors, boosting your opportunities of getting the resources you require to expand., businesses ought to on a regular basis integrate their accounts.

They guarantee on-time payment of bills and quick consumer settlement of invoices. This improves capital and aids to stay clear of late penalties. An accountant will certainly go across financial institution declarations with inner documents at the very least as soon as a month to locate blunders or inconsistencies. Called financial institution settlement, this process guarantees that the economic documents of the company match those of the bank.

They keep an eye on present payroll data, subtract tax obligations, and figure pay scales. Accountants create fundamental monetary reports, consisting of: Revenue and Loss Statements Shows earnings, expenditures, and web profit. Equilibrium Sheets Details possessions, liabilities, and equity. Capital Statements Tracks cash activity in and out of business (https://writeablog.net/hirestonewell/rqhr1mxsuw). These records aid organization owners recognize their financial position and make informed decisions.

Stonewell Bookkeeping Things To Know Before You Buy

While this is affordable, it can be taxing and vulnerable to errors. Devices like copyright, Xero, and FreshBooks enable company proprietors to automate bookkeeping jobs. These programs assist with invoicing, bank settlement, and financial coverage.